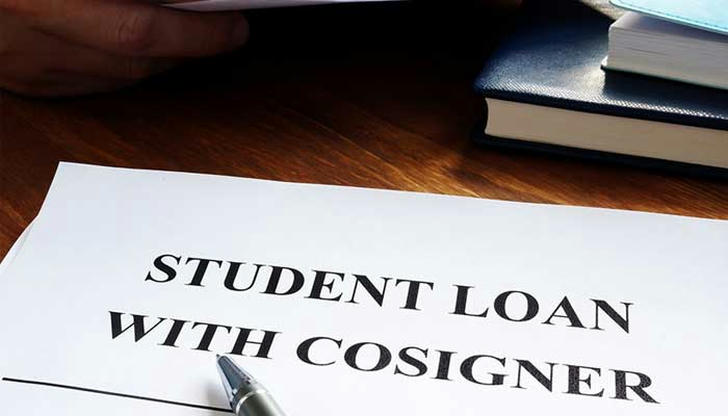

The Role of Cosigners in Student Loans: Risks and Benefits Explained

When it comes to financing higher education, student loans often play a crucial role. For many students, securing a loan without a cosigner can be challenging due to limited credit history or low income. This is where a cosigner steps in, acting as a safety net for lenders. But what does being a cosigner mean, and what are the risks and benefits involved? Let's break it down.

What is a Cosigner?

A cosigner is someone who agrees to take joint responsibility for a loan. They sign the loan agreement alongside the primary borrower and promise to pay back the loan if the borrower fails to do so. This additional assurance can help the student get approved for a loan they might not qualify for on their own.

Why are Cosigners important for Student Loans?

Most college students have little to no credit history, which makes it tough for lenders to assess their ability to repay. Adding a cosigner—usually a parent, guardian, or relative—improves the borrower’s creditworthiness. Here’s why cosigners are crucial:

• Approval Odds: A cosigner significantly boosts the chances of approval.

• Lower Interest Rates: With a cosigner, the loan often comes with a lower interest rate, reducing the overall cost of borrowing.

• Access to Higher Loan Amounts: Lenders are more willing to extend larger amounts when a creditworthy cosigner is involved.

Benefits of Being a Cosigner

Though cosigning a loan can be risky, it also comes with some notable benefits:

Helping a Loved One: Cosigning allows you to support a family member or friend’s educational goals.

Building Trust: Successfully paying off a loan can strengthen relationships and foster trust between the borrower and cosigner.

Potential Credit Boost: If the borrower makes timely payments, it can positively impact the cosigner’s credit score.

Risks of Being a Cosigner

However, cosigning isn’t all positive. There are significant risks to consider:

• Credit Impact: If the borrower misses payments, the cosigner’s credit score takes a hit.

• Debt Liability: Cosigners are legally responsible for the loan, which could affect their ability to qualify for other credit.

• Potential Strain on Relationships: Financial strain or loan defaults can lead to conflicts and stress between the borrower and cosigner.

What to Consider Before Cosigning?

Before agreeing to cosign a student loan, consider the following points carefully:

• Financial Stability: Ensure that you are financially stable enough to handle loan payments if needed.

• Clear Communication: Discuss expectations and responsibilities with the borrower beforehand.

• Loan Terms: Read and fully understand the loan agreement’s terms and conditions.

• Cosigner Release Options: Some lenders offer a cosigner release after a set number of on-time payments. This can relieve the cosigner of their obligations.

How to Protect Yourself as a Cosigner?

If you decide to move forward, take these precautions:

• Monitor Loan Payments: Stay updated on the borrower’s payment status to catch potential issues early.

• Budget for Payments: Be prepared to make payments in case the borrower defaults.

• Get Insurance: Consider taking out an insurance policy that covers loan payments if the primary borrower is unable to pay due to unforeseen circumstances.

Alternatives to Cosigning

If you are hesitant to cosign, explore these alternatives:

• Federal Student Loans: These don’t require cosigners and come with borrower-friendly repayment options.

• Scholarships and Grants: Encourage the borrower to apply for financial aid that doesn’t need to be repaid.

• Work-Study Programs: These can help students earn money to offset tuition costs.

• Private Loans Without Cosigners: Some lenders offer loans specifically for students without a cosigner, though they often have higher interest rates.

Final Thoughts

Cosigning a student loan can be both a rewarding and risky endeavor. It’s an opportunity to help a loved one pursue their educational dreams but comes with financial and credit implications. Weighing the pros and cons and understanding all aspects of the agreement are crucial before signing on the dotted line.

If you’re considering cosigning a student loan, take your time to research, communicate openly with the borrower, and make sure it’s a decision that aligns with your financial situation. By doing so, you can protect both your credit and your relationship while supporting someone’s future.