All about Income-Based Personal Loans | Pros and Cons

So, when it concerns the provision of personal loans, income-based plans are trending. These loans approve the loans and the discretion of the loan terms according to the earnings, and thus, it is popular among many people. Nevertheless, they share certain advantages and some disadvantages as well. That is why to make the correct decision in choosing such a loan it is crucial to learn about all the advantages and disadvantages of income-based personal loans.

What are Income-Based Personal Loans?

Personal loans are defeated with elasticity in mind. Contrary to other conventional loans which consider credit scores as paramount, these loans consider income. Banks and other financial institutions use the gross and net earnings, plus total financial prosperity to determine loan size and terms of repayment.

Why Choose an Income-Based Personal Loan?

Income-based personal loans are attractive for a few reasons:

1. Easier Access for Those with Limited Credit History

One of the major advantages is accessibility. If you have little or no credit history, getting approved for a traditional loan can be tough. However, with an income-based loan, lenders primarily evaluate your income. This makes it a viable option for young adults or those trying to build their credit from scratch.

2. Flexible Loan Terms

Since these loans are tailored to your income, you might get more personalized repayment terms. This could mean lower monthly payments that fit your budget, allowing for better financial planning.

3. Potentially Lower Interest Rates

In some cases, if your income is steady and relatively high, you might qualify for lower interest rates compared to unsecured loans. This is because lenders perceive you as less risky if you have a strong, consistent income.

Potential Downsides of Income-Based Personal Loans

Despite their advantages, income-based loans are not perfect. Here are some downsides to consider:

1. Higher Interest Rates for Lower Incomes

If your income is on the lower side, you might end up with higher interest rates. Lenders view lower income as a potential risk, so they offset this by charging more in interest. This can make the loan costlier over time.

2. Limited Loan Amounts

Your loan amount depends directly on your income. This can be a challenge if you need a significant sum for a large expense. Lenders may cap your loan to an amount that fits within your ability to repay comfortably, even if it falls short of what you need.

3. Strict Documentation Requirements

Getting approved for an income-based personal loan often involves thorough vetting. You’ll need to provide various forms of documentation, such as pay stubs, tax returns, or bank statements. The process can feel invasive and time-consuming.

Who Can Benefit the Most from These Loans?

Income-based personal loans work best for:

• Freelancers and Self-Employed Individuals

If you’re self-employed, providing a steady income for a traditional loan can be tricky. Income-based lenders often have more flexible criteria that can accommodate the fluctuating income common in freelancing.

• Young Professionals

If you’ve just started your career and don’t have an extensive credit history, income-based loans can help. They provide an opportunity to borrow money without being penalized for a lack of credit.

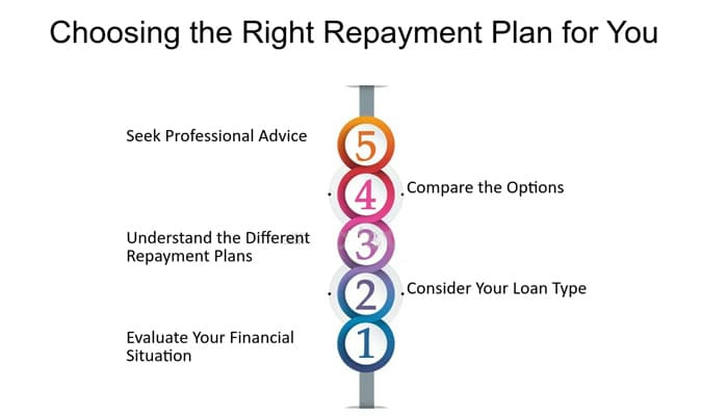

Key Tips for Choosing the Right Income-Based Loan

If you decide to pursue this type of loan, keep the following in mind:

• Compare Lenders: Not all income-based loans are the same. Some lenders offer better rates and terms than others, so it pays to shop around.

• Read the Fine Print: Understand the terms and conditions. Look for any hidden fees, such as prepayment penalties or origination charges.

• Plan Your Budget: Make sure you can comfortably manage the monthly payments. Falling behind can harm your credit score and financial health.

How to Apply for an Income-Based Personal Loan?

Applying for an income-based loan involves a few straightforward steps:

Check Your Eligibility: Ensure you meet the lender’s income requirements. Most will have a minimum threshold you must meet to qualify.

Gather Your Documents: Collect proof of income, such as recent pay stubs, tax returns, or bank statements.

Submit Your Application: Complete the application online or in person, depending on the lender.

Review the Offer: Once approved, carefully review the loan terms and ensure they fit your financial situation before accepting.

Alternatives to Income-Based Personal Loans

Before committing, it’s wise to explore alternatives:

• Credit Union Loans: These often have more forgiving lending standards and may provide better terms.

• Peer-to-Peer Lending: Platforms like LendingClub or Prosper can offer more competitive rates and flexible terms.

• Co-signed Loans: If your income is low but you have someone willing to co-sign, this could help you secure a loan with better terms.

Conclusion

Income-stream personal loans are perfect for people, who need the loan and have good income rates but bad credit. Although consumers ‘get more or receive more from these loans such as easier access and special loan repayment terms, consumers are drawn back by high interest rates and stringent documentation requirements. Consult with different lenders, analyze all the options and the interest rates involved, and always remember to read the small print before signing the contracts with the chosen lender.