Why Low-Interest Home Loans Are the Smart Choice for Buyers?

Buying a home is a significant milestone, and for many, it’s one of the biggest financial commitments. When navigating the sea of loan options, low-interest home loans stand out as a smart choice for buyers. But what makes them so appealing? Let’s break down the reasons why opting for a low-interest loan can save you money and set you up for financial success.

What Is a Low-Interest Home Loan?

A low-interest home loan is a mortgage offered at a lower interest rate compared to the market average. Interest rates can vary due to factors like the borrower’s credit score, loan term, and type of lender. Securing a loan with a low interest rate means you’ll pay less over time, keeping more money in your pocket.

Top Benefits of Low-Interest Home Loans

1. Lower Monthly Payments

When the interest rate is low, your monthly payment decreases. This can make it easier to budget and afford your home without financial strain.

For example, if you take a $300,000 mortgage at 3% interest versus 5%, your monthly payment could be significantly lower, saving you hundreds of dollars each month.

2. Reduced Total Interest Paid

Over the life of a loan, the interest you pay can add up to tens of thousands of dollars. A lower interest rate reduces this amount, helping you save a substantial sum over time.

This means more of your payments go toward paying down the principal balance rather than just covering interest.

How to Qualify for a Low-Interest Loan?

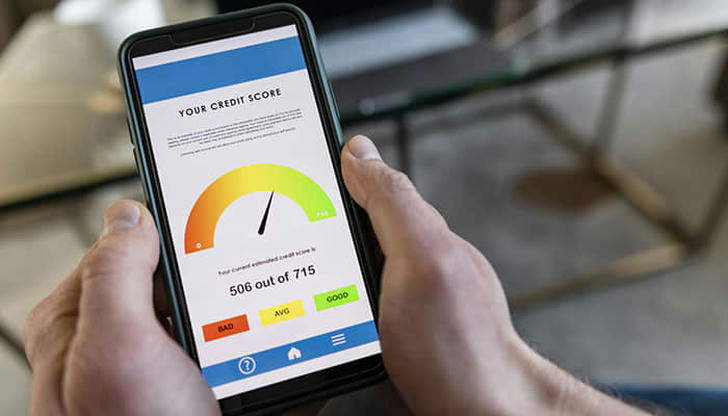

1. Improve Your Credit Score

• Your credit score is a key factor that lenders consider when offering loan rates. A higher score can secure better terms.

• Ways to boost your score:

Pay bills on time.

Reduce outstanding debt.

Avoid opening new credit lines before applying.

2. Shop Around for the Best Rates

• Not all lenders offer the same rates, so it’s important to compare.

• Online comparison tools and speaking to multiple banks or credit unions can help you find the best deal.

3. Consider a Larger Down Payment

• A larger down payment can lower the amount you need to borrow, which may help you qualify for a lower rate.

• Aim for at least 20% if possible. This can also help you avoid private mortgage insurance (PMI), which adds to your monthly costs.

Long-Term Financial Advantages

1. Easier Future Planning

• With lower monthly payments, budgeting for other expenses becomes simpler. You can allocate more money to savings, investments, or other financial goals.

2. Quicker Equity Buildup

• Low-interest loans help you build equity faster. With more of your payment going toward the principal, you own more of your home sooner. This can be a safety net for future financial needs, such as home improvements or unexpected expenses.

Common Misconceptions About Low-Interest Loans

“Low-interest rates are only for first-time buyers.”

False. While first-time buyers may have specific programs, low-interest loans are available to any qualified borrower.

“They come with hidden fees.”

Not always. Reputable lenders offer transparent terms. It’s important to read the fine print and ask questions.

Tips for Securing the Best Low-Interest Loan

1. Lock in Your Rate Early

Rates can fluctuate due to market conditions. If you find a great rate, consider locking it in to avoid potential increases.

2. Maintain Financial Stability

Keep your finances steady between the time you apply and when you close on the loan. Avoid big purchases or new credit applications.

Final Thoughts: Making Low-Interest Loans Work for You

Opting for a low-interest home loan can set you up for long-term savings and financial stability. By preparing ahead of time and understanding what lenders look for, you can increase your chances of securing a loan that helps you reach your homeownership dreams without unnecessary stress.

Taking the time to research, improve your credit, and compare offers ensures that you make the smartest financial move possible. In the end, a low-interest home loan is more than just a good deal—it’s a step toward a more secure financial future.