Tips for Migrants Seeking Home Loans in a New Country

Starting a new life in another country is exciting but challenging, especially when securing a home loan. The process might seem daunting with different regulations, financial requirements, and unfamiliar terminology. But with the right approach and understanding, migrants can confidently navigate this path.

Here are key tips for migrants considering applying for a home loan in their new country.

1. Understand Your Financial Standing

Before applying for a home loan, assess your current financial status. Ensure you have a clear overview of your income, expenses, savings, and debts. Many lenders require a solid credit history as part of their approval process.

• Check your credit score: Some countries, like the U.S., have specific credit scoring systems that might be different from your home country’s. If you don’t have a credit history in your new country, consider starting to build one as soon as possible.

• Budget wisely: Know how much you can afford as a down payment and for monthly mortgage installments.

2. Learn the Local Mortgage Market

Different countries have varying regulations and practices for home loans. Understanding the local mortgage market can help you find better options and avoid surprises.

• Research common loan types: For example, fixed-rate and variable-rate mortgages come with different risks and benefits. Learn which one suits your needs best.

• Compare lenders: Check the interest rates, terms, and flexibility different financial institutions offer. Online mortgage comparison tools can simplify this step.

• Seek professional advice: Consulting with a local mortgage broker can provide valuable insights and help you find tailored solutions.

3. Gather Necessary Documentation

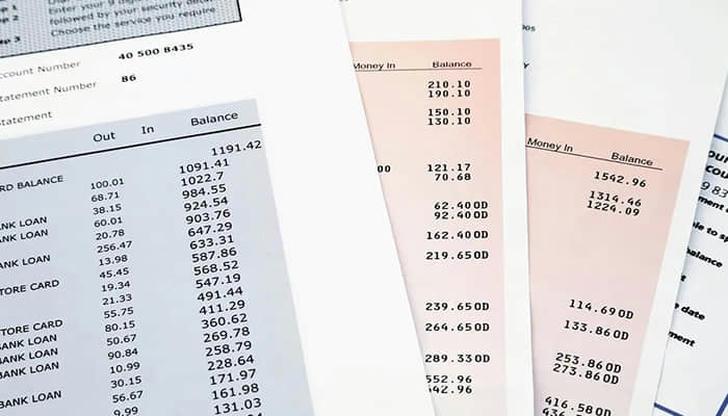

Applying for a home loan requires documentation that proves your identity, financial stability, and ability to repay the loan.

• ID proof: Ensure you have an official government ID and residency documents.

• Employment records: Many lenders ask for proof of income. This could be your employment contract, pay stubs, or tax returns.

• Bank statements: Typically, you’ll need to show statements from the past 3-6 months to illustrate your financial stability.

• Proof of savings: Lenders may also want to see evidence of your savings for a down payment.

4. Build Your Credit Profile

If you are new to the country, your credit history may be non-existent. Here’s how to start building it:

• Open a local bank account: Having a local account helps establish your financial presence.

• Use a secured credit card: Making small, regular purchases and paying them off on time will gradually build your credit score.

• Pay bills on time: Consistently paying rent, utility bills, and other expenses can show your reliability.

5. Understand Additional Costs

Beyond the loan amount, buying a house includes other expenses that many first-time buyers overlook.

• Closing costs include legal fees, appraisal fees, and taxes.

• Property taxes and insurance: Familiarize yourself with the recurring costs that come with owning a home.

• Maintenance costs: Be prepared for unexpected repairs and maintenance to keep your home in good shape.

6. Save for a Bigger Down Payment

A larger down payment can be beneficial for several reasons:

• Lower monthly payments: The more you pay upfront, the smaller your loan amount will be, which means lower monthly payments.

• Better interest rates: Lenders may offer better terms if you make a significant down payment, as it reduces their risk.

• Avoiding private mortgage insurance (PMI): In some countries, if your down payment is less than 20% of the home’s value, you may have to pay PMI, which adds to your monthly costs.

7. Prepare for Exchange Rate Fluctuations (If Applicable)

If you’re earning income in a different currency than your loan, be mindful of exchange rate changes. These can impact your ability to make payments and could increase your monthly expenses.

8. Stay Patient and Persistent

Securing a home loan as a migrant can take time. You might face rejections or need to shop around more than a resident would. Don’t get discouraged. Each application process teaches you more about what lenders are looking for and brings you closer to your goal.

Conclusion

Getting a home loan as a migrant is a major milestone that requires careful preparation and a good understanding of the local financial landscape. By assessing your financial standing, researching mortgage options, gathering essential documents, building your credit profile, and being aware of all costs involved, you can set yourself up for success. Persistence and a strategic approach will make the journey smoother and more rewarding.