Top Online Platforms for Affordable Bad Credit Loans in 2025

Navigating the world of loans can be stressful, especially if you have a less-than-perfect credit score. Traditional banks may not be an option, and finding a reliable, affordable loan online becomes crucial. Thankfully, many online platforms cater to individuals with bad credit, offering loans with fair terms and transparent processes. This guide will explore the top online platforms for bad credit loans in 2025, so you can make an informed choice.

What to Look for in a Bad Credit Loan Platform?

Before diving into specific platforms, it’s important to know what makes a loan platform trustworthy and affordable. Here are a few key factors to consider:

• Interest Rates and Fees: Always compare the annual percentage rate (APR) and any additional fees.

• Repayment Terms: Check if the platform offers flexible repayment options.

• Transparency: Ensure that the platform clearly states all loan conditions.

• Customer Reviews: User experiences can provide valuable insights into the platform's reliability.

Top Platforms for Bad Credit Loans in 2025

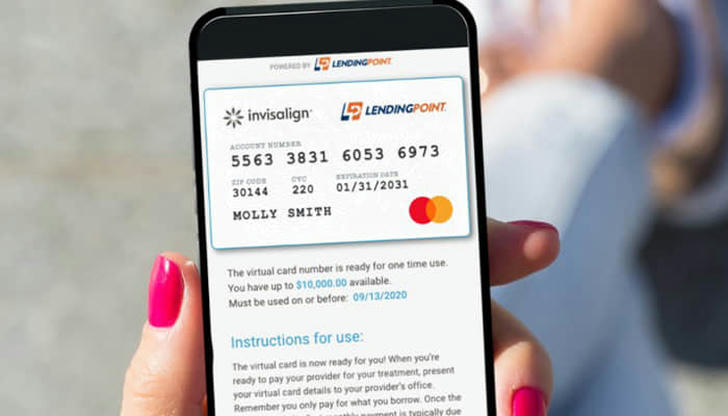

1. LendingPoint

LendingPoint is a popular choice for individuals with credit scores as low as 580. This platform stands out for its simple application process and fast funding.

• APR Range: 7.99% - 35.99%

• Loan Amounts: $2,000 - $36,500

• Repayment Terms: 24 to 60 months

• Pros: Quick approval, flexible repayment options

• Cons: Higher interest rates for lower credit scores

Why it’s great: LendingPoint’s user-friendly approach and reasonable APR make it an excellent option for borrowers needing funds fast.

2. Upgrade

Upgrade has built a strong reputation for providing loans to those with credit scores starting at 560. The platform combines competitive interest rates with educational resources to help users improve their financial health.

• APR Range: 8.49% - 35.97%

• Loan Amounts: $1,000 - $50,000

• Repayment Terms: 24 to 84 months

• Pros: Low minimum credit score requirement, credit-building tools

• Cons: Origination fees can be up to 8%

Why it’s great: Upgrade’s robust support system and loan options help users with bad credit secure financing and grow their credit scores over time.

3. Avant

Avant is another reliable platform, catering specifically to those with fair to bad credit. It’s ideal for borrowers who may not qualify for loans from more traditional lenders.

• APR Range: 9.95% - 35.99%

• Loan Amounts: $2,000 - $35,000

• Repayment Terms: 12 to 60 months

• Pros: Soft credit check for pre-qualification, quick funding

• Cons: Higher fees for some users

Why it’s great: Avant’s accessible loan options and smooth application process make it a practical choice for quick funding needs.

4. OneMain Financial

OneMain Financial caters to borrowers who prefer a more personal touch, offering in-person services at various branch locations.

• APR Range: 18% - 35.99%

• Loan Amounts: $1,500 - $20,000

• Repayment Terms: 24 to 60 months

• Pros: Personal service, no minimum credit score requirement

• Cons: Higher APRs compared to other platforms

Why it’s great: For those who value face-to-face service, OneMain Financial offers both digital and in-person support, making the loan process smoother.

Tips for Securing a Better Loan

While choosing the right platform is crucial, there are steps you can take to secure a better deal:

• Improve Your Credit: Even a small increase in your credit score can lower your interest rate.

• Compare Multiple Offers: Use loan comparison tools to find the best terms.

• Watch for Red Flags: Be wary of platforms that require upfront fees or seem too good to be true.

• Consider a Co-Signer: If possible, having a co-signer with a better credit score can help you secure lower interest rates.

Conclusion: Make an Informed Decision

Finding an affordable bad credit loan in 2025 doesn’t have to be overwhelming. By knowing what to look for and considering platforms like LendingPoint, Upgrade, Avant, and OneMain Financial, you can take the first step toward securing the funds you need. Always read the fine print and use the tips mentioned to make the most of your loan search.

Remember: Borrow responsibly and prioritize your financial well-being. With the right approach, you can manage your current needs while setting a foundation for better financial health in the future.