Best Auto Loan Rates & Financing in 2024: How to Compare Lenders and Save

How Auto Loans Work

An auto loan is a financial agreement where a lender provides you with the funds to purchase a car. In return, you agree to repay the loan in fixed monthly installments over a set period, typically between 24 and 84 months. Most auto loans are "secured," meaning the lender holds the car's title as collateral until the loan is fully paid off. If you miss payments, they can repossess the vehicle. Once you've completed your payments, the title transfers to you, and you own the car outright.

To ensure you get the best deal, it’s important to shop around and compare offers from multiple lenders, as the terms and rates can vary.

How to Compare Auto Loan Rates and Lenders

Several factors can influence the auto loan rate you’re offered, your monthly payment, and even whether you're approved for a loan. Since each lender may weigh these factors differently, it’s important to compare multiple offers before committing.

Here are some key factors lenders consider:

Your Credit and Financial Situation

Lenders will assess your income, credit score, employment history, debt-to-income ratio, and overall financial health when determining whether to approve your loan and what rate to offer. Credit scores typically range from 300 to 850, and most lenders rely on the FICO or VantageScore models to assess your creditworthiness. Some lenders may also use industry-specific models, which can further impact your loan decision.

What You Can Do:

1. Check Your Credit Report: Ensure your credit report is accurate by requesting a free copy from the major bureaus (Equifax, Experian, and TransUnion) at AnnualCreditReport.com. If there are any errors, dispute them.

2. Know Your Credit Score: Your credit score can help you gauge what rates you might expect. Many banks, credit card issuers, and even sites like NerdWallet offer free access to your score.

3. Consider Lenders That Look Beyond Credit Scores: Some lenders take a broader view of your financial history, including education or work history, which may help you qualify for better rates even with a lower credit score.

The Type of Vehicle and Loan Amount

The car you're buying can also affect the loan rate. Generally, loans for new cars tend to have lower interest rates, while loans for used cars (especially from private sellers) may carry higher rates.

What You Can Do:

1. Choose Your Car Wisely: If you're looking to save on interest, consider a more affordable car or one that holds its value well.

2. Know Lender Rate Structures: Some lenders, like credit unions, may offer the same rates for new and used cars or be more flexible about what constitutes a “new” car.

3. Make a Down Payment: A larger down payment reduces the loan amount and lowers the risk for the lender, which could result in a better interest rate.

Your Loan Term

The loan term—the length of time you have to repay the loan—impacts both your monthly payment and the total interest paid over the life of the loan. While a longer loan term may result in lower monthly payments, you’ll ultimately pay more in interest.

What You Can Do:

1. Consider Shorter Loan Terms: Although a longer loan term may lower your monthly payments, it could increase the overall interest cost. NerdWallet recommends limiting new car loans to 60 months and used car loans to 36 months, if possible.

2. Compare Loan Offers by Term: Make sure you're comparing loans with the same term length to get an accurate picture of your monthly payments and total cost.

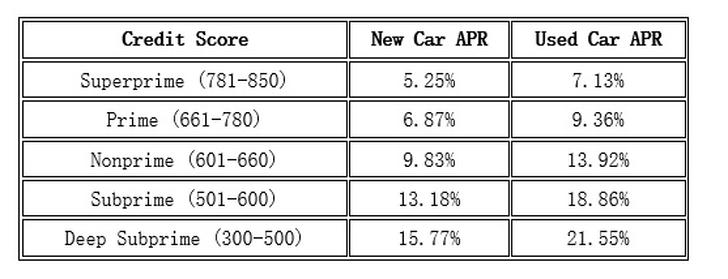

Average Auto Loan Rates by Credit Score

Understanding the average rates for different credit score ranges can help you gauge where you stand in the lending process. According to Experian's second-quarter 2024 data, the average APRs for new and used cars were as follows:

For people with higher credit scores, the rates will be lower, while those with scores below 600 may face significantly higher rates.

Are Auto Loan Rates Rising or Falling?

Auto loan rates generally track the direction of the Federal Reserve's interest rate changes, though they aren’t directly linked. Since the Fed began raising rates in 2022, car loan rates have been climbing, reaching their highest levels in years. Keep an eye on Fed policy changes, as they often signal future movements in auto loan rates.

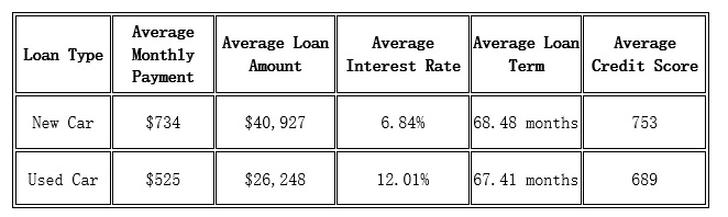

What Determines Your Monthly Car Payment?

Your monthly car payment depends on several factors, including your loan amount, interest rate, term length, and credit score. Here are the averages based on Experian's second-quarter 2024 data:

Get Pre-Qualified or Preapproved with Multiple Lenders

To get a clear picture of your financing options, consider getting pre-qualified or preapproved by several lenders. This will allow you to compare rates, terms, and repayment options, helping you find the best deal.

• Pre-qualification typically involves a soft credit inquiry and gives you an estimate of what you might be approved for.

• Preapproval requires a hard credit inquiry and is a more formal offer, giving you a better sense of your potential loan terms and rates.

Types of Auto Loans

While this article primarily focuses on new and used car loans, there are several other types of auto loans available:

1. Auto Refinancing Loans: If you already have an auto loan, refinancing can help you secure a lower interest rate or reduce your monthly payment.

2. Cash-out Auto Refinance Loans: These loans allow you to borrow extra funds against the equity in your car.

3. Lease Buyout Loans: If you're leasing a car and want to buy it at the end of your lease term, a lease buyout loan can help.

4. Bad Credit Auto Loans: Lenders that specialize in bad credit loans may offer higher rates but are more flexible with applicants who have poor credit.

5. First-Time Car Buyer Loans: These loans are designed for people with no previous auto loan or credit history, although they often come with higher interest rates.

By shopping around and comparing different lenders and loan options, you can ensure you get the best possible deal on your next auto loan.