Need money urgently? Get a CommBank Loan Today

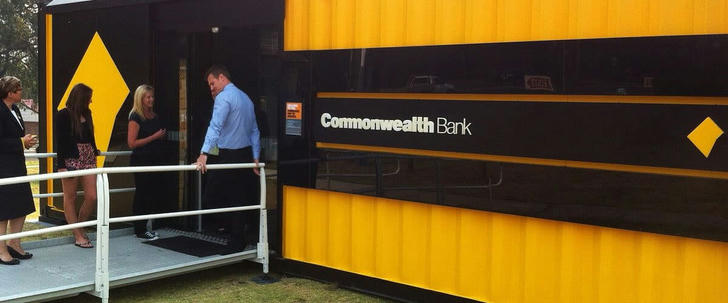

When you're in a financial crunch and need money quickly, taking out a loan can be a viable solution. In Australia, one of the largest and most trusted banks, Commonwealth Bank of Australia (CommBank), offers quick loans to help people in need of fast financial assistance.

Here’s a clear guide to help you navigate the process and decide if a CommBank loan is the right choice

Why Choose a CommBank Loan?

Commonwealth Bank of Australia (CommBank) is one of the largest financial institutions in the country. It offers various loan products tailored to different customer needs. Here’s why a CommBank loan might be an attractive option:

1. Fast and Simple Application Process

Complete the online application in about 15 minutes, and get a response in as little as 60 seconds.

You could receive the funds on the same day you apply (if eligible)

2. Competitive Interest Rates

For a bank of its size, CommBank offers competitive interest rates on personal loans, especially for borrowers with good credit scores. The rates may vary depending on the loan type and your creditworthiness, but they are typically lower than payday loans or other high-interest borrowing options.

3. Flexible Loan Terms

CommBank offers flexible loan terms, ranging from a few months to several years, depending on the amount you borrow and the type of loan you choose. You can also choose between fixed or variable interest rates, giving you the ability to tailor the loan to your financial situation.

Choose a personal loan that’s right for you

1.Make additional repayments or close your loan without incurring any fees

2.Borrow from $4,000 to $50,000 over a term of one to seven years

3.$0 establishment fee

Applying for a personal loan is easy

Apply

Apply online on the commbank official website. It will take about 15 minutes and they’ll ask you some details. You can also apply over the phone or in branch.

Response

After you submit, they’ll give you a response in 60 seconds.

Contract

If approved, they’ll send you a contract. Accept the contract if you’re happy with the terms

Are you eligible to apply?

To be eligible to apply for a personal loan, you must:

• Be at least 18 years old

• Be an Australian or New Zealand citizen, Australian Permanent resident, or hold an eligible visa

• Meet minimum income requirements

Ready to Get the Financial Help You Need?

With a simple application process, competitive interest rates, and flexible repayment options, CommBank makes it easier than ever to get the funds you need quickly.

Don’t wait—Apply Now for Your CommBank Personal Loan

Need more information? Visit CommBank's official website or contact them for personalized assistance.

Cases around you:

• Name: Sarah Thompson

• Age: 30

• Occupation: Marketing Specialist

• Location: Sydney, Australia

• Situation:

Sarah Thompson needed $10,000 urgently for medical expenses and car repairs. With a strong credit score of 750, she decided to apply for a personal loan through Commonwealth Bank (CommBank).

She quickly filled out the online loan application, providing details about her income and financial situation. Within 60 seconds, she received pre-approval for the loan, pending verification. A loan officer explained she could borrow $10,000 at a 6.5% fixed interest rate over 3 years, with no establishment fee and no penalty for early repayment.

Sarah accepted the offer, signed the contract electronically, and received the funds the same day. Throughout the loan term, she made regular repayments and occasionally paid extra without penalties. Thanks to the quick, transparent process, Sarah managed her financial emergency without high-interest payday loans, feeling satisfied with the bank’s service and support.