Get a free credit card-no annual fee, no interest easily: You can apply even if you have bad credit!

In modern society, credit cards have become an indispensable part of our daily lives. Whether it is shopping, traveling or emergency expenses, credit cards can provide convenience and financial support. And more and more credit card products are no longer limited to those with high credit scores. Even if you have a bad credit record, you have the opportunity to apply for a free credit card and enjoy free annual fees, free interest and various super value benefits.

You can apply even if you have bad credit: change your perception of credit cards

For a long time, many people believed that only people with good credit can apply for high-quality credit cards, especially those with no annual fees and no interest. In fact, with the diversification of financial products and the increased flexibility of financial institutions in credit scoring, people with bad credit can also find a credit card that suits them. Many banks and financial companies have launched credit cards specifically for applicants with imperfect credit records, which not only allow them to apply, but also provide considerable benefits.

No annual fee, no interest: save you money and peace of mind

There are many credit cards on the market that offer no annual fee and no interest, which means you can enjoy the convenience of credit cards without paying extra fees.

No annual fee

Many banks and financial institutions now offer no annual fee for credit cards. Whether you are applying for the first time or holding the card for a long time, the annual fee is no longer a problem.

Interest-free period

Some credit cards also offer an "interest-free period", that is, within a certain billing cycle, if you pay the full amount on time, you do not need to pay interest. This not only helps you avoid additional charges due to interest, but also gives you greater financial flexibility in emergencies.

Flexible repayment options

Even if you occasionally fail to repay on time, many credit cards also offer more flexible repayment plans to help you gradually restore your credit record.

Several companies that provide free credit cards

- Barclaycard:

One of the earliest credit card companies in the UK, it offers a variety of credit card options, including no annual fee cards, travel reward cards, cash back cards, etc.

- Halifax:

It provides a variety of personal banking services, including credit card services, no annual fee and flexible repayment periods, suitable for a variety of different needs, including student cards, cash back cards, etc.

- Lloyds Bank:

It is one of the major banks in the UK and offers a variety of credit cards, including travel cards, cash back cards, and low-interest cards.

- MBNA:

One of the major credit card providers in the UK, it offers various types of credit cards, including travel rewards cards, cash back cards, and credit cards suitable for students.

- American Express:

An American company, but it also provides credit card services in the UK. It offers high-end credit cards, which are usually suitable for high-spending and frequent business travelers. It offers generous rewards and travel benefits.

What are the benefits of a credit card with no annual fee?

No fees can help reduce your borrowing costs

No need to worry about additional fees when you don't use the card

If you want an emergency backup card, this is a good low-cost option

Some cards with no annual fee also offer an introductory period of 0% interest.

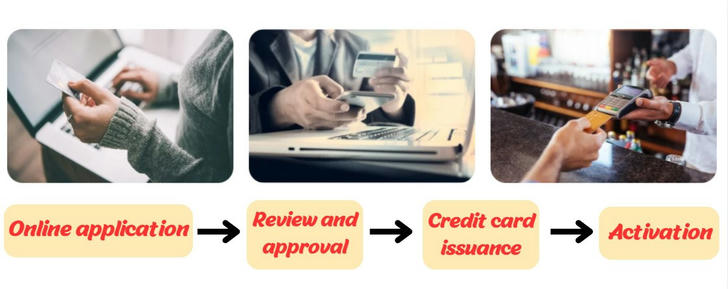

How to apply for a free credit card?

Choose a suitable credit card

Apply online

You can usually apply online through the bank's official website or application.

- Review and approval

After submitting your application, the bank or credit card company will review it, which may be completed within a few minutes to a few days. After the review is passed, the bank will notify you whether the credit card is approved and inform you of your credit limit.

- Credit card issuance

Once approved, your credit card will be mailed to your address within a few days to a week.

- Activation

•Call the bank's activation hotline.

•Activate online.

•Activate at the bank's ATM.

Conclusion

Today, credit cards are not only a payment tool, but also an important tool for rebuilding credit, enjoying benefits, and improving the quality of life. Even if your credit is not perfect, you can still find a credit card product that suits you and enjoy various benefits such as no annual fee and no interest. By using credit cards reasonably, you can easily manage your finances, improve your credit record, and get more credit card benefits in the future. Don't hesitate, come and apply for your free credit card and enjoy a worry-free life!